Partnerships with Cooperatives and Credit Providers for Climate Change Adaptation and Mitigation

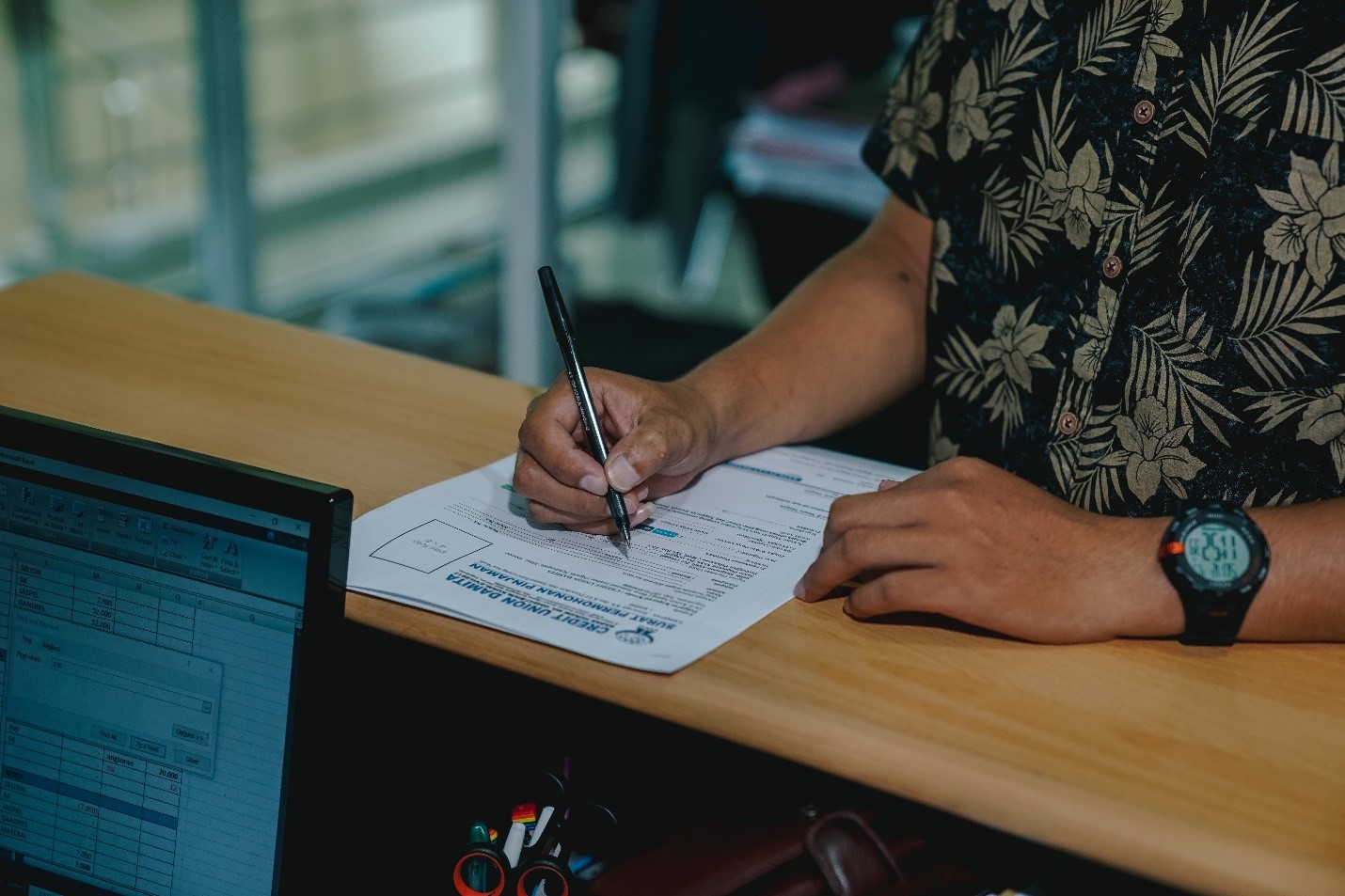

Yayasan Rumah Energi (YRE) has collaborated with cooperatives and institutions providing credit access to carry out its vision and mission. YRE is active in providing access to renewable energy and food security in the form of a biodigester as a sustainable local energy source through the development of a market-oriented biogas sector in several provinces in Indonesia through the Indonesia Domestic Biogas Programme or known as BIRU program. To date, the BIRU Program has supported more than 27,893 farmers in gaining access to domestic biogas technology in 14 provinces and provided various financing schemes in 5 provinces.

In carrying out the BIRU program from 2012 to the present, YRE has succeeded in building partner groups that serve as experts, mapping potential users, increasing the capacity of CPO (Construction Partner Organization), facilitating credit, and a team to monitor biogas quality. Cooperatives and local credit providers have become agents of micro-scale change that assist the implementation of YRE’s vision and mission.

Access to credit will enable beneficiaries (biogas users), as well as business entities in the biogas sector to access biogas loans, both in the Business to Business (B to B) and Business to Consumer (B to C) concepts. YRE and Hivos have established strategic partnerships with financial institutions, such as Rabo Bank Foundation, Savings and Loan Cooperatives, KIVA, Inkopdit (The Parent of Cooperatives and Credit) and LPDB in the last 11 years. A total of 9,289 households or 40% of the total digester construction have obtained access to biogas credit schemes in 5 (five) provinces.

Since 2009 the BIRU program has partnered with more than 35 cooperatives that help provide credit for the construction of biogas installations. One example of the collaboration carried out is with Nestle Indonesia, which since 2010 through the Corporate Share Value (CSV) program has supported access to domestic biogas technology with interest-free loans distributed to cooperative members. Nestle Indonesia fosters 30,000 farmers through their cooperative partners. As of April 2021, more than 8,000 members of dairy farmers already have biogas installations that are paid for through milk deposits with an average payment of 36 months. To date, the total loan disbursed from 8,000 farmers is IDR 36,000,000,000. In addition, this partnership resulted in several Dairy Cooperatives acting as BIRU Program Construction Partners. This effort aims to ensure the quality of the bio-digester and obtain additional benefits for the cooperative.

Continuing the previous year’s collaboration, Hivos through the BIRU Program held a biogas credit financing partnership through the Rabo Bank Foundation (RBF) partner in Indonesia. To distribute RBF loans for the construction of biogas installations, YRE has partnered with RBF partners from dairy/productive cooperatives or sharia-based cooperatives in the provinces of East Java, Central Java, D.I. Yogyakarta, and South Sulawesi. The financing model is that RBF provides loans to cooperatives or CUs, so that the cooperatives provide credit services to members for the construction of biogas installations with repayments at harvest or monthly. For financing, it is not only specific for biogas development but can also be used to procure livestock (cows) as a supporter of biogas.

In order to be able to reach more beneficiaries with soft loans, in 2020 YRE started an assessment with the Revolving Funding Fund Institution (LPDB). And in early 2021 as many as 3 YRE partner cooperatives have been registered as cooperatives that apply for biogas credit funding from LPDB. The scheme provided is not much different from RBF so that loan funds are given to cooperatives and cooperatives provide biogas financing for their members.

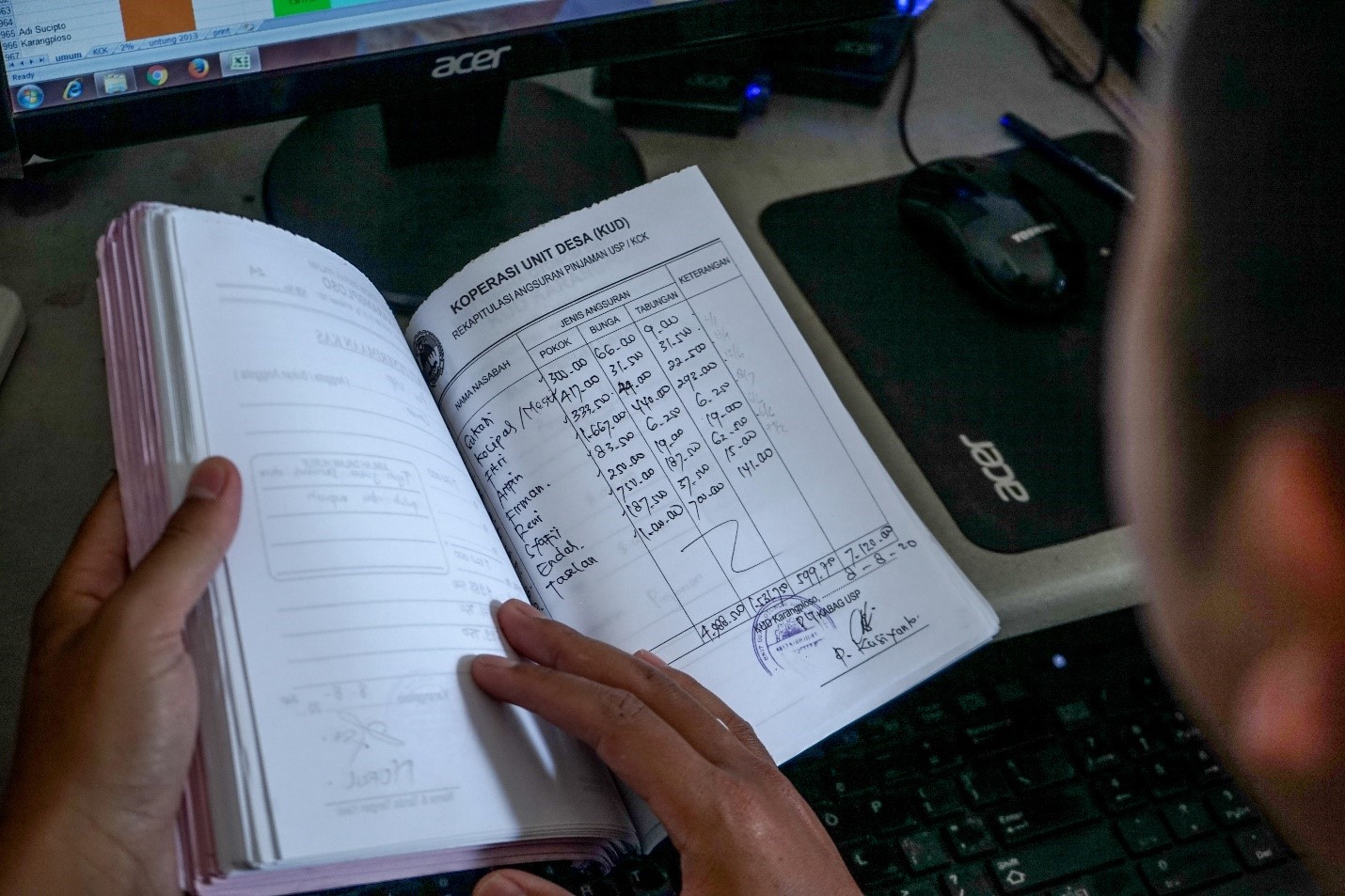

Starting from 2015 until this year YRE has collaborated with the Indonesian Credit Union Movement Network (GKKI). The partnership started with a Memorandum of Understanding (MoU) between YRE and INKOPDIT to support 1,500 Credit Union (CU) members to build biogas plants and create businesses related to bio-slurry with CU members in the BIRU Program work area. INKOPDIT through PUSKOPDIT (Coordination Office for CU Province) and the Primary Credit Union is committed to finding potential farmers among its members who want to build biogas installations. Currently, 14 biogas units have been built through CUs, namely Damita CU in Yogya, Sauan Sibarung CU in Toraja, Anak Mandiri CU in Ponorogo and Bintang Utama CU on Muna Island. The CU, apart from building biogas, has also conducted training to builders for the development of the biogas market so that the institution already has experts in accordance with the BIRU Program standards.

One of the Puskopdit in the DIY area is currently collaborating with RBF to further strengthen the biogas development movement for its members and it is planned that within 3 years it will be able to build approximately 100 biogas units, so it is hoped that it can be used as a model for other CUs for biogas development in their institutions.

During late 2020, YRE noted a decline in the number of requests for bio-digesters through access to credit. It has been found that there are several problems encountered in the payment of biogas loans with collaboration networks with Nestle, INKOPDIT, Cooperatives and CU, namely management problems and low saving behavior. Especially with the pandemic situation which has a significant impact on the demand for biogas for its members. In addition, Cooperatives also have a priority to maintain liquidity and members prefer to prioritize meeting basic needs. Technical matters also have an effect due to restrictions in the field due to the high Covid-19 conditions in some areas.

In particular, the lack of financial literacy skills / low saving behavior and excessive credit burden among farmers are some of the main challenges that must be overcome to maintain the biogas market demand. This will be linked to the management and behavior of Farmer Households in daily activities. YRE has attempted to focus on educational and promotional factors to improve the managerial skills, saving habits and financial literacy of farmers. For example, by providing capacity building through the Training on Trainers (TOT) Financial Action Learning System (FALS) for Cooperatives and CU institutions, which will later be forwarded at the institutional and member levels to conduct training, mentoring for candidates and members of biogas users related to financial management for prospective and members of biogas users to reduce the risk of Non-Performing Loans (NPL). This is proven by one of the cooperatives in Central Java with members who have received financial education, so that he is quite orderly in paying off biogas credit, even before the due date he has deposited the installments.

YRE’s experience proves that access to microfinance must be the backbone of the Renewable Energy sector, in particular, the development of the biogas market in Indonesia. More opportunities to access credit financing will increase demand and supply capacity. In relation to the SDG targets, the massive development of the biogas market will support the achievement of SDGs-1, 2, 5, 6, 7, 10, 12, 13.