Cooperatives as Change Agents in Financing Climate Change Mitigation and Adaptation Workshop

Yayasan Rumah Energi (YRE) and the Parent Credit Cooperative (INKOPDIT) took the initiative to start a green collaboration initiative. This initiative is a concrete form of involving cooperatives as one of the agents of change that encourages low-carbon activities to the ground level through micro-scale financing schemes. These activities can be sectoral in nature such as financing for renewable energy, sustainable agricultural commodities or multi-sectoral activities that combine the two. However, it requires a deep understanding of the impacts of climate change, the risks that arise to the financing activities of cooperatives/credit unions as well as innovations in climate change adaptation and mitigation activities. It is hoped that with this understanding, a movement will be formed among cooperatives/credit unions that support financing for low-carbon development nationally. On this basis, YRE together with INKOPDIT and partners will hold a series of workshops to understand the issues that will eventually form a joint movement between cooperatives/credit unions and stakeholders.

In an effort to start the Green Initiatives program involving cooperatives and Micro Finance Institutions (MFIs) to finance climate mitigation and adaptation actions on a local scale, YRE and the Parent Cooperative Credit (INKOPDIT) collaborated in launching a workshop “Cooperatives as Agents of Change in Mitigation and Adaptation Financing. Climate Change” which was held for two days on 23 – 24 June 2021.

This workshop activity includes 2 main themes that are carried out as a start. The first is the supporting policies as well as the ongoing landscape of climate change financing. The second is the initiatives available for MFIs to undertake using renewable energy technologies and sustainable commodities.

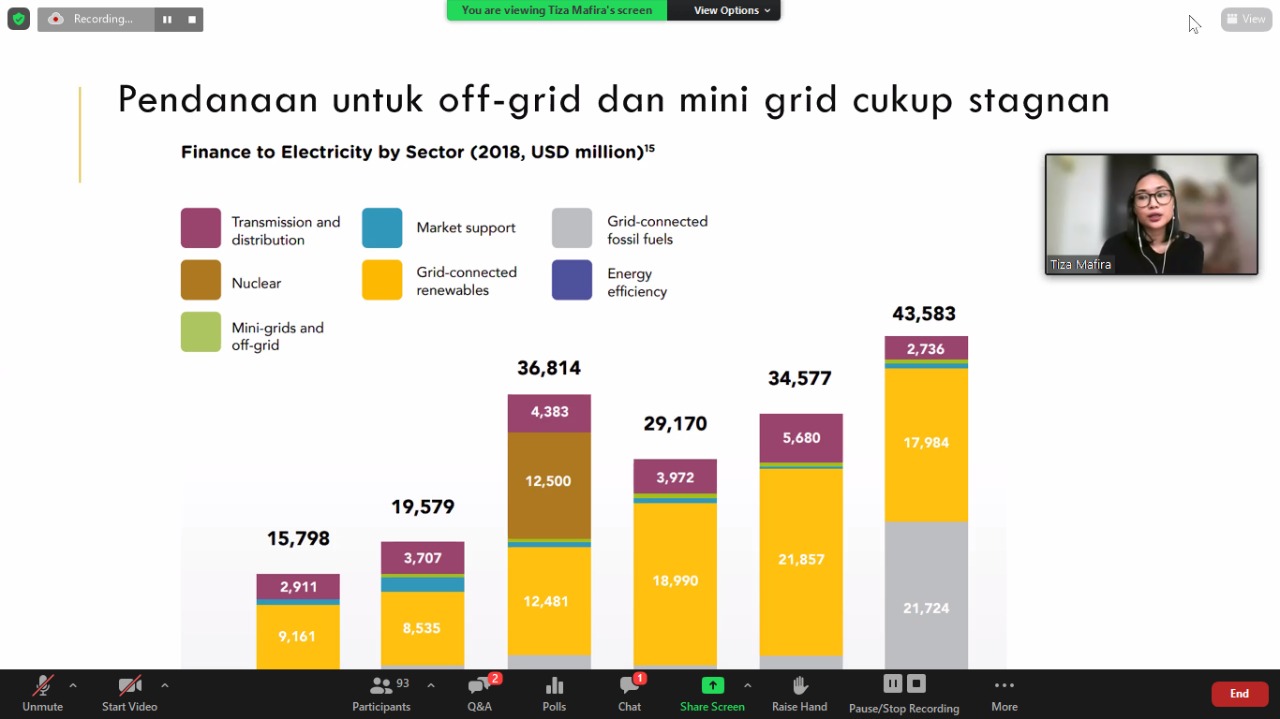

The first day was filled by Mr. Stephanus Siagian representing INKOPDIT delivering material on how INKOPDIT’s role in encouraging sustainable low-carbon financing, Mr. Ari Gunawan from the Ministry of Cooperatives and Small and Medium Enterprises on policies and programs to encourage financing of climate change, Tiza Mafira from Climate Policy Initiatives (CPI). ) delivered landscape materials for national and international funding for climate change adaptation and mitigation activities, and Pak Nugroho from Dekopindo for East Java explained Dekopindo’s role in encouraging the capacity of MFIs to support climate change financing.

For the second day, Marlistya Citraningrum from IESR conveyed the strategy for the realization of the 1 Million Solar Roofs Movement of Indonesia, Fitrian Ardiansyah from the Green Trade Initiative (IDH) regarding the market potential of sustainable agricultural and plantation commodities, Pak Sucipto from the Pancur Kasih Credit Union shared his experience in financing climate change which has been run, and Mrs. Ida Ayu Maharatni from the Amoghasiddhi Cooperative who shared her experience as a cooperative that provides solar PV services to its members.

The conclusion drawn from this workshop is the need for strategies from various parties from the government, policy makers, communities, and MFIs to work hand in hand on how cooperatives and MFIs can get a share in the financing of climate change adaptation and mitigation. Because so far, with various initiatives that exist in the community and such great potential, cooperatives and MFIs are still not many who have a focus on financing climate change.

This workshop is only the beginning, furthermore, YRE will continue to empower cooperatives and MFIs to become more resilient in their role as climate action financing institutions through the upcoming Green Initiatives program.